Perspective 78

What Happens When We Do Not Focus on Growth?

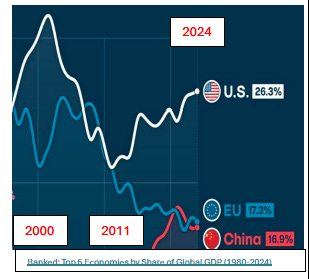

Today I write about the challenges we face in our economy. Everybody has a priority, but the only one that is central is growth. A chart shows how the US has sustained its share of global GDP since 2011 while Europe has gotten behind. There is something we can learn here.

I mention 'the lapping of waves on the beach' in this essay. I'm trying to look at tides and currents while the news I see/read is constantly focused on each wave and storm.

While this is, I hope, a timely focus on the economy, there are much larger currents that affect our world. I write my other non-economics essays on those topics.

Pray for the prisoners...and lots more.

Blessings,

John

Here is the full chart. The Biggest Drivers of Global GDP (1980-2024) - Voronoi

And another link on debt. (I pasted it and it works).

https://thvnext.bing.com/th/id/OIP.gQ400kbrEPcI9O8ojs2nIwHaEv?cb=thvnext&rs=1&pid=ImgDetMain

What Happens When We Do Not Focus on Growth? Economic Prospect May 23, 2025 John Teevan

The remarkable separation between the U.S. and the European Union economies since 2000 is evident in this graph. Let’s explore the challenges we have in sustaining our U.S. growth. We must be very careful. U.S. growth has been dramatically affected by six annual $2-3trillion-dollar deficits. Can we sustain this level of debt-financed spending? We cannot.

The graph compares the U.S. to the E.U. There are times, as recently as 2008, when the E.U. exceeded the U.S. in terms of the share of global GDP. However, since about 2011, the U.S. has grown while E.U.’s growth has fallen. The chart shows that the E.U. has shrunk to 17.3% of Global GDP while the U.S. with higher growth has climbed to 26.3% of Global GDP.

The challenges:

1. Our misguided plan: The game plan is that deficits do not matter (but they do), and that the government will know when to quit spending just in time to avoid significant inflation (but they did not). Whose idea is that? People who believe in Modern Monetary Theory that strong governments can print and spend money without danger. Our economy has passed that danger point and had inflation, with no slowdown in debt spending or renunciation of MMT.

2. Why do we have such deficits? High spending for Covid put some benefits at new elevated levels that benefited more people and still do. The Inflation Reduction Act was an open-ended commitment to environmental priorities that have sent billions to those new priorities. Entitlements are already familiar to us.

3. Governments find it difficult to measure outcomes. So, the more people we cover, and the more money we spend must mean more success. This is the opposite of a business model where you must have outcomes. Environmental or educational outcomes may be minimal (even negative) but it’s ok because ‘we spent more.’

4. Competence makes minor difference Governments talk about priorities while businesses talk about profits. If we measure competence by priority spending, then competence in outcomes makes little difference.

5. The Fed has kept interest rates low, until lately, but this is not normal, and it does not provide a return for those who loan to governments or businesses. We are supposed to be happy if we get our money back without any real (inflation adjusted) income. Debtors love this, especially Uncle Sam, but the era of near zero interest rates may finally (20 yr bond just touched 5%) be ending (I’ve been wrong on this before).

6. Congress has the unusual problem of passing very few bills and is not doing its job as we all know.

7. An imperial presidency along with a paralyzed Congress is unsustainable and even harmful. Presidents, since Obama, have expanded the ‘power of the pen’ for executive orders to get things done.

This week’s effort in Congress to continue the 2017 Tax Cuts will either spur growth or it will just cut taxes for the IRS-tax-paying half of Americans. Yet we hear news that is as useless as the sound of waves lapping on a beach. We need to consider the ‘currents’ and navigate accordingly.

Focusing on economic growth is effective. Mississippi now has greater GDP per capita than France. Why? MS, like the turtle, grew enough to catch the stalled French rabbit. Growth matters. Whatever grows the economic pie is preferable to whatever may, even legitimately, redistribute that pie. Ask Europe.

In other areas, the universities are facing declining enrollment numbers, poor prospects in each foreseeable year, and a strange commitment, among the elite schools, to tolerating or denying the evil of antisemitism. The Federal Reserve, though they have made real mistakes, are still the only adults in DC. The president’s use of tariffs, reorganization, and foreign diplomacy has been disruptive, but the net effects are far from certain. Repairing our errors and focusing on growth is the economic path forward. A good start.